It feels like just yesterday when I received my acceptance letter to York. As a naïve high school student, I was beyond excited. All I could think about was the frosh week parties, meeting and interacting with all kinds of new people, and exploring the campus and anything else nearby that might spike my interest. Needless to say, my mind was on everything but the education.

But who could blame me? University is such a new and exciting experience for someone so young and impressionable. Fast forward to today when the shroud of youthful indiscretion has at least somewhat faded and I am right on the heels of graduating, I can’t help but laugh at my former self for neglecting arguably the most important aspect of a university education: the finances.

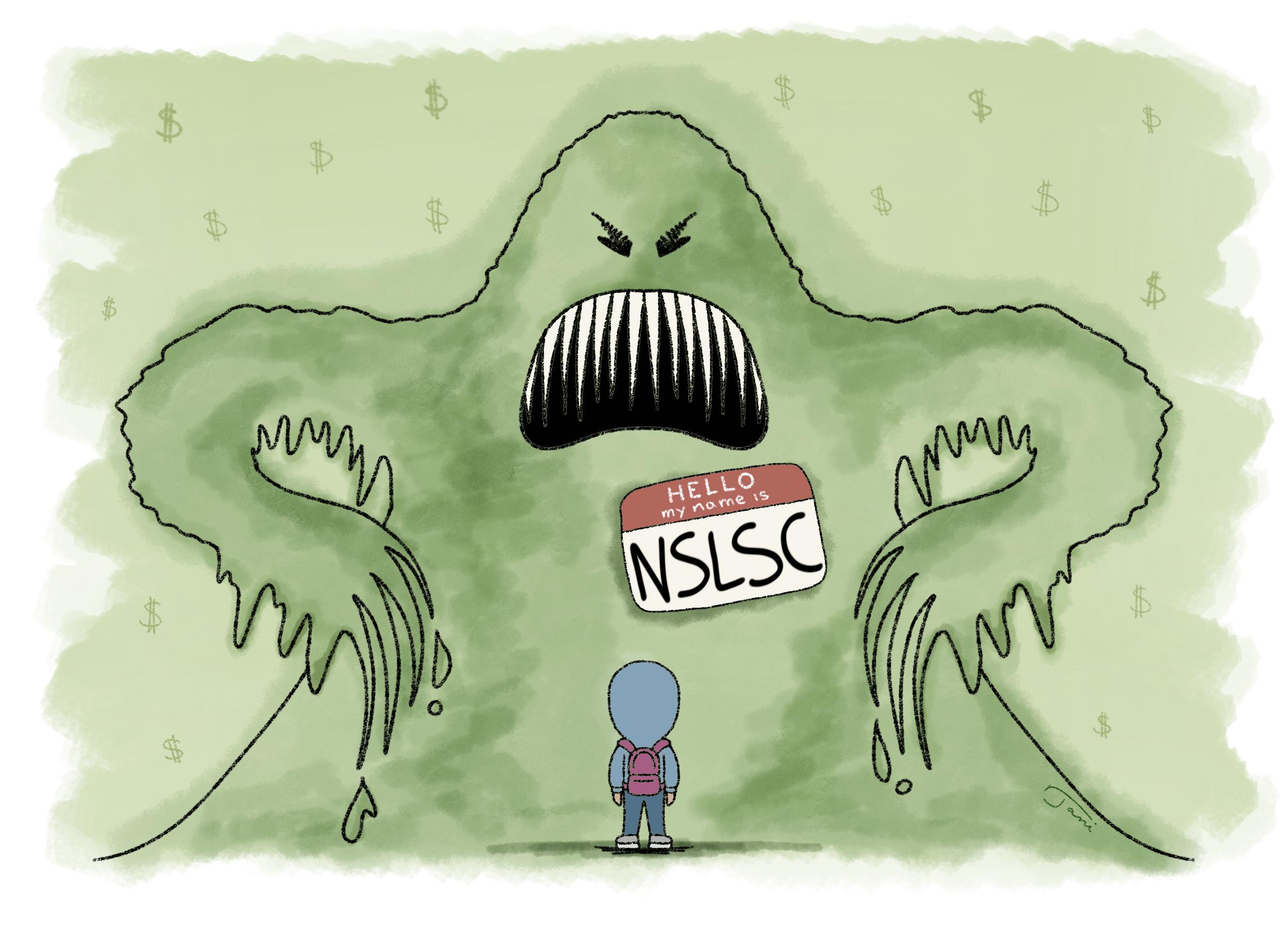

Year after year, I became accustomed to the mindless process of filling out an OSAP application the summer before school started, having my tuition paid and then giving no attention to it until the next year. Were these loans piling up? Of course. Did I care? Definitely not. In my mind, student loans were a boogeyman to be confronted in the distant future when I graduated with a prestigious job all lined up for me. That is how it’s supposed to go…right?

Spoiler alert: That isn’t how it’s supposed to go. Or maybe it is on paper, but the reality is, it probably won’t. While the unemployment rate for university graduates is only 6.7 per cent, the lowest among all levels of education, the average student debt is more than $28,000 and the majority of students take 10 years to pay off their loans, according to the Canadian Student Loan Program. Bet you didn’t realize you were signing up for 10 years of repayments when you started school, right?

Yet this ends up being the exact reality for most people. At the inexperienced age of 18, we are undertaking our first and likely one of the biggest financial decisions of our lives without even realizing it. A decision that, if not approached responsibly, could destroy one’s credit and quality of life for a very long time.

As the dreaded repayment dates slowly encroach on me, I look back and realize I probably could have weighed the decision behind going to university more responsibly. I wouldn’t go so far as to say attending university was a mistake, however, the reasons that I and many others around me had for attending may have not been the best.

“My parents want me to go,” “everyone else is doing it so I might as well,” “I don’t know what else to do,” or even “I just want to party,” are likely some of the common reasons you’d hear sitting in on a conversation with newly graduated high school students. And yet none of these are even remotely strong enough to justify a price tag in the tens of thousands of dollars.

This is not meant to be an anti-university rant, but rather pro-making-informed-decisions. If university is the path you are choosing to take, you are undoubtedly exposing yourself to opportunities you would have never otherwise had. The important thing is to remember that these experiences do come at a steep price that you will have to face sooner than you think.

It is imperative that you have a solid reason for studying your chosen major, take full advantage of campus resources, evaluate your potential employment prospects upon graduation, and be responsible when it comes to your money.

University is definitely an experience, but it is also an investment — the sooner you think of it as such, the sooner you’ll be able to evaluate what that entails and how to prepare for it.